In the journey of securing the financial future of our children and grandchildren, one enduring gift stands out — Whole Life insurance. More than just a policy, it’s a cornerstone for generational wealth, offering stability, flexibility, and a legacy that transcends lifetimes. At GMIS, we understand the significance of this gift and how it can pave the way for a lifetime of financial security for your loved ones.

Building a Solid Foundation

Imagine being able to provide your children and grandchildren with a stable financial foundation from the moment they are born. Whole Life insurance offers just that. By gifting a policy to your young ones, you’re setting them up for a lifetime of financial security, irrespective of the uncertainties that lie ahead.

Whole Life insurance provides a safety net that empowers them to navigate life’s challenges with confidence, including assisting with major life events like:

- College tuition & education costs

- Weddings

- Down payment on a new home

- Starting a new business

- Supplementing retirement income

Ensuring Insurability and Locking in Premiums

One of the significant advantages of Whole Life insurance is that it guarantees insurability regardless of any future health conditions. By securing coverage for your child at a young age, you lock in lower premiums, capitalizing on their good health and minimizing future costs. This foresight ensures that they have access to the protection they need, regardless of what the future holds.

Growing Value Over Time

Unlike other investments that are subject to market fluctuations, Whole Life insurance is designed to grow and accumulate value over the long term. As long as premiums are paid, and there are no loans or withdrawals, the policy’s value never decreases. This means that over time, your gift not only provides financial security but also grows into a valuable asset that can be tapped into when needed, whether it’s for education expenses, starting a business, or making a down payment on a home.

A Strategic Planning Tool

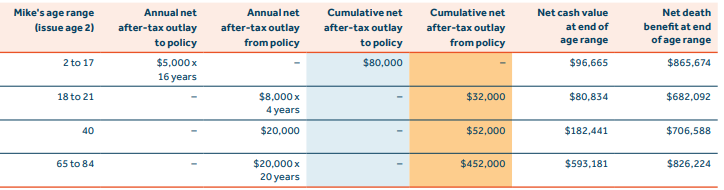

Let’s consider a case study to illustrate the strategic benefits of gifting Whole Life insurance:

- Grandparents purchase a Whole Life insurance policy for their two-year-old grandchild, gifting the premium annually.

- By the time their grandchild enters college, the policy’s cash value serves as a supplement to cover tuition expenses.

- Later in life, the accumulated cash value helps the grandchild make a down payment on a home and provides additional income during retirement.

- Through strategic planning, the grandparents not only reduce their taxable estate but also ensure a lasting legacy for future generations.

Conclusion

Whole Life insurance isn’t just a policy; it’s a testament to your commitment to securing the financial well-being of your loved ones for generations to come. At GMIS, we believe in the power of this enduring gift and are here to help you navigate the complexities of insurance planning to create a legacy that stands the test of time.

Contact us today to learn more about how Whole Life insurance can benefit your children and grandchildren, and let’s start building a brighter financial future together.

Have questions? Our team at GMIS is here to help.

At Grand Mutual Insurance Services, we are committed to providing you with the most up to date information on the insurance market. Reach out to our GMIS Life & Health Department today for personalized guidance, and maximize advantages for growth and success:

[email protected]

818.587.6046